Finding a no-income proof credit card as a new immigrant can feel impossible, especially when you’re just starting out in the U.S. without a job or credit history. But good news: several major issuers offer options that don’t require proof of income and still allow you to build your credit from day one.

Whether you’re a student, spouse on a dependent visa, or new green card holder, getting access to a starter credit card without a pay stub is key to establishing your financial life in the United States.

Let’s explore the best no-income proof credit cards for new immigrants in 2025, including secured cards, international partner programs, and alternative credit scoring tools designed for newcomers.

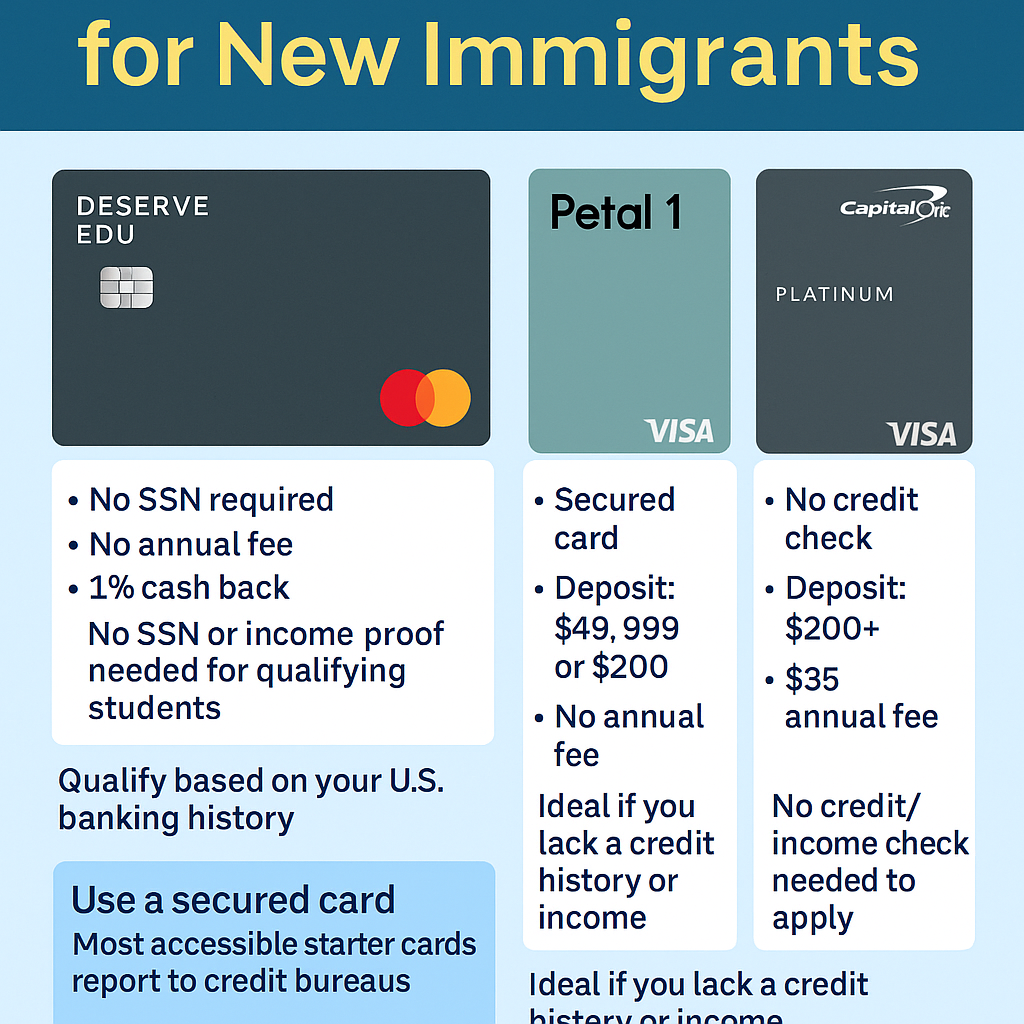

1. Deserve EDU Mastercard

Deserve EDU is one of the most immigrant-friendly credit cards in the U.S. It requires no SSN for international students and doesn’t ask for income proof if you’re applying through a university partner. Backed by Mastercard and Sallie Mae, this unsecured card helps you start building credit immediately.

Key Features:

-

No SSN or income proof required (for qualifying students)

-

No annual fee

-

1% cash back on all purchases

-

Free Amazon Prime Student (6 months)

Who it’s best for: F-1 visa students and new immigrants attending U.S. universities

2. Petal® 1 “No Annual Fee” Visa Credit Card

Petal uses a tool called Cash Score to evaluate applicants based on banking history instead of just credit score or income. If you have a U.S. bank account—even without regular income—you may qualify. It’s an unsecured card, so no deposit is needed.

Key Features:

-

No security deposit required

-

$300–$5,000 credit limit based on your banking history

-

Reports to all three credit bureaus

-

No foreign transaction fees

Who it’s best for: Immigrants with U.S. bank accounts but no employment or W-2 income

3. Capital One Platinum Secured Credit Card

This card doesn’t require income proof if you can provide a refundable deposit. It’s one of the only secured cards that offers the opportunity for a higher credit line after on-time payments—without any additional deposit.

Key Features:

-

Initial deposit as low as $49 for a $200 limit

-

No annual fee

-

Automatic credit line reviews in 6 months

-

Accepted worldwide

Who it’s best for: New immigrants without income but able to fund a security deposit

4. Tomo Credit Card

Tomo doesn’t run a credit check or ask for income proof. Instead, it links directly to your U.S. bank account to evaluate cash flow. It’s a charge card, so the balance must be paid in full every week—but it’s perfect for building credit from scratch.

Key Features:

-

No credit score or income required

-

No fees (annual, late, or foreign transaction)

-

Reports to all major credit bureaus

-

Weekly auto-pay from your bank

Who it’s best for: Newcomers with consistent bank activity, even without income

5. OpenSky® Secured Visa® Credit Card

This is one of the most accessible secured cards on the market. OpenSky does not require a credit check or proof of income, and it’s ideal if you want to jump-start your credit without a U.S. credit history or employer.

Key Features:

-

$200 refundable deposit

-

No credit check or income verification

-

Reports monthly to Equifax, Experian, and TransUnion

-

$35 annual fee

Who it’s best for: Immigrants with no SSN or financial background in the U.S.

Comparison Table: Best No-Income Proof Credit Cards (2025)

| Credit Card | Type | Deposit Required | SSN Needed | Annual Fee | Ideal For |

|---|---|---|---|---|---|

| Deserve EDU | Unsecured | No | No | $0 | Students, F-1 visa holders |

| Petal 1 Visa | Unsecured | No | Yes | $0 | Immigrants with bank accounts |

| Capital One Secured | Secured | Yes | Yes | $0 | Those with funds but no income |

| Tomo Credit Card | Charge | No | No | $0 | Active bank users with no income |

| OpenSky Secured Visa | Secured | Yes | No | $35 | Immigrants with no SSN/income |

Tips for New Immigrants Applying Without Income Proof

Use a U.S. bank account. Many alternative credit card issuers will assess your cash flow if they can link to your checking account.

Try a secured card first. If no unsecured options are available, start with a secured card that reports to the credit bureaus. You’ll still build credit just the same.

Add a co-signer or become an authorized user. If your spouse or family member has an account, they may add you to help you build your score.

Watch for scams. Legitimate credit cards will never charge a “processing fee” before approval. Stick with trusted issuers.

Pay in full and on time. Credit history matters more than income over time. A six-month clean record can qualify you for upgrades or better cards fast.

Do You Need SSN to Apply?

Not always. Some cards, like Deserve EDU and OpenSky, don’t require an SSN. Others, like Petal or Capital One, may request it but don’t use traditional credit scoring methods.

In most cases, an ITIN (Individual Taxpayer Identification Number) can be used instead if you’re not yet eligible for an SSN.

Final Thoughts

For newcomers to the U.S., the path to financial independence begins with the right credit card. The best no-income proof credit cards for new immigrants in 2025 are specifically designed to give you a head start—without traditional employment or U.S. credit history.

Start with what you have: a bank account, a student visa, or a refundable deposit. Within a few months of responsible use, you’ll have the foundation needed to upgrade to better offers, unlock credit limits, and finance your life with confidence.

#NewImmigrants #CreditCardsUSA #BuildCredit #NoIncomeProof #CreditCardTips2025 #RazBlogFinance

Website: http://razblog.com