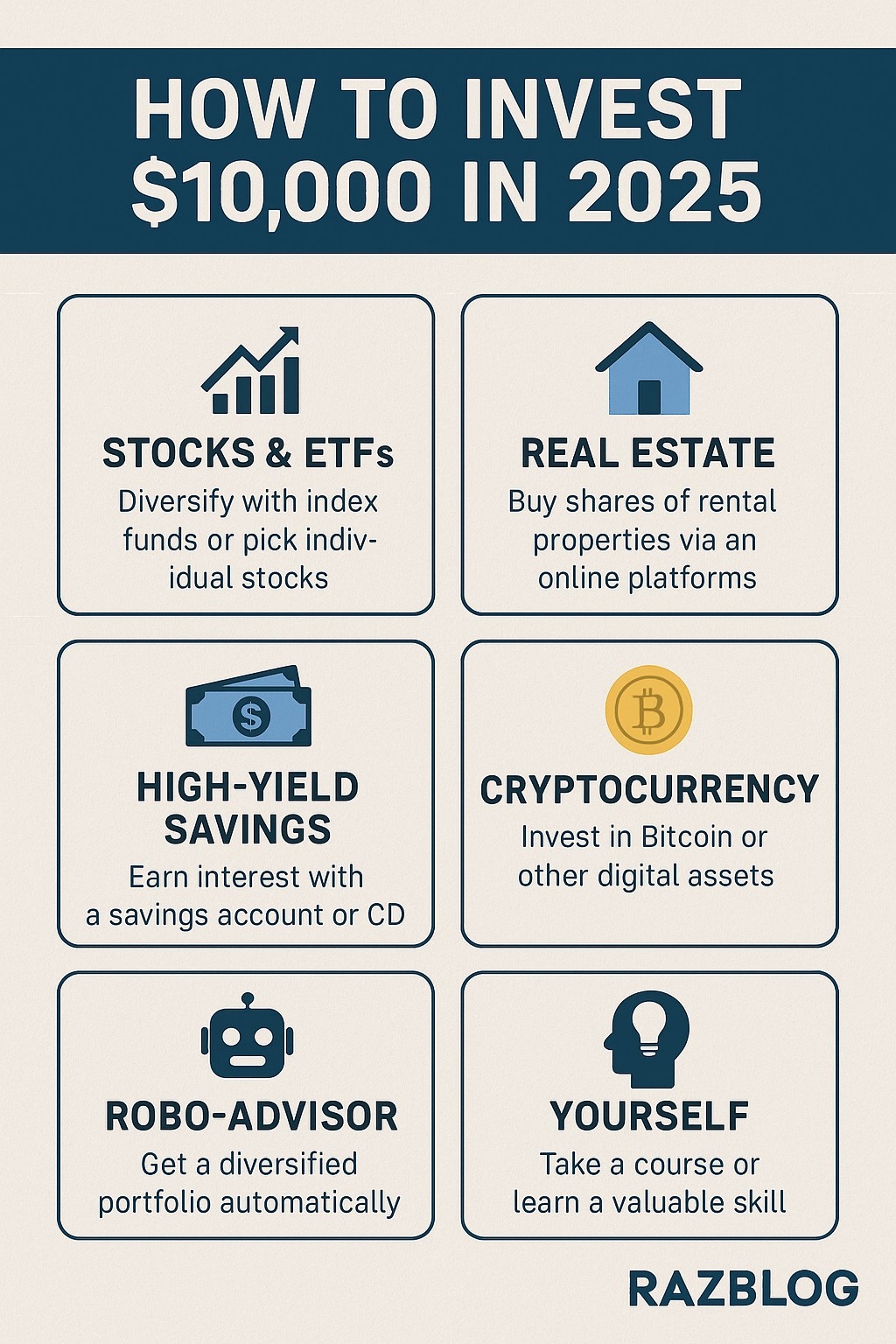

If you’re wondering how to invest $10,000 in 2025, you’re in a strong position to grow wealth, secure your financial future, and potentially outperform inflation. Whether you earned it through a bonus, tax refund, or savings, investing this lump sum wisely can make a serious difference.

The challenge is knowing which options will give you the best returns while aligning with your risk level, timeline, and goals. In 2025, economic conditions are shifting, with AI-driven stocks, high-yield cash alternatives, and fractional real estate leading investor interest.

Before diving into the best investment options, ask yourself three things: What is your investment goal (growth, income, safety)? What’s your timeline (1 year, 5 years, retirement)? And how much risk are you comfortable taking?

If you have a medium to high risk tolerance and want long-term gains, putting your $10,000 in the stock market remains a top choice. ETFs (exchange-traded funds) give you diversified exposure to sectors like tech, healthcare, and AI without picking individual stocks. A popular starting mix includes 70% in a total U.S. stock market ETF like VTI, 20% in an international ETF like VXUS, and 10% in a bond ETF for balance.

For investors who prefer direct ownership, picking individual growth stocks like Nvidia, Amazon, or Tesla in 2025 may offer bigger upside—but they come with more volatility. If you’re not comfortable timing the market or researching companies deeply, ETFs provide a lower-maintenance path to solid returns.

Real estate remains a powerhouse for long-term wealth, but not everyone can afford a property. Fortunately, you can invest as little as $10 in fractional real estate through platforms like Fundrise or Arrived Homes. With $10,000, you could build a portfolio across residential and commercial properties with consistent cash flow.

Cryptocurrency may not be the hot trend it was in 2021, but it’s evolving into a core hedge asset. Allocating 5–10% of your $10,000 to Bitcoin or Ethereum can provide upside potential. Use platforms like Coinbase or Gemini, and store long-term holdings in a hardware wallet. This option is high-risk, high-reward, so only invest what you can afford to lose.

If you’re looking for safety and short-term growth, high-yield savings accounts or certificates of deposit (CDs) in 2025 are now offering between 4.5% and 5.2% APY. These won’t make you rich, but they preserve your principal while outpacing inflation. Consider online banks like Ally, Marcus, or SoFi for the best rates.

For hands-off investors, robo-advisors like Betterment or Wealthfront let you deposit your $10,000 and get an AI-managed portfolio tailored to your goals. These platforms rebalance automatically and reinvest dividends, and fees are usually around 0.25% annually.

Let’s compare these options side-by-side.

Comparison Table: Best Ways to Invest $10,000 in 2025

| Option | Risk Level | Potential Return | Liquidity | Best For |

|---|---|---|---|---|

| Stock Market (ETFs) | Medium | 7–10% annually | High (liquid) | Long-term growth investors |

| Individual Stocks | High | 10%+ annually | High | Risk-tolerant, active traders |

| Real Estate Platforms | Medium | 6–9% annually | Medium (90-day+) | Passive income, diversification |

| Cryptocurrency | Very High | 0–100%+ | High | Speculative allocation |

| High-Yield Savings/CDs | Low | 4.5–5.2% | High | Safety, emergency savings |

| Robo-Advisors | Low-Med | 5–8% | High | Beginners, hands-off investors |

You don’t have to pick just one. A smart investor spreads risk by allocating across multiple categories. Here’s a sample diversified portfolio:

-

$4,000 in ETFs (VTI, VXUS, BND)

-

$2,000 in fractional real estate via Fundrise

-

$1,000 in crypto (BTC, ETH)

-

$2,000 in a high-yield savings account (as a buffer)

-

$1,000 in a robo-advisor portfolio

This approach balances growth, security, and flexibility—ideal for most investors in 2025.

Want to invest in yourself? That’s also a strong move. Use $10,000 to acquire high-ROI skills like coding, digital marketing, AI tools, or business development through bootcamps or certifications. These often generate returns far greater than the market over time.

Here are a few extra tips:

Use a tax-advantaged account like a Roth IRA if you’re eligible. Your investments grow tax-free and can be withdrawn tax-free in retirement.

Automate your investments where possible. This builds discipline and keeps you consistent.

Reinvest all earnings and dividends. Compounding is where long-term gains really take off.

Avoid putting the full $10,000 in one high-risk asset unless you’re okay losing it all. Even in a bull market, protection matters.

Track your portfolio quarterly. Make sure your allocation aligns with your goals and timeline.

So if you’re still asking how to invest $10,000 in 2025, start by understanding your financial goal, spread your risk, and stay committed. With smart choices, you can turn that one-time sum into a strong financial foundation for years to come.

#Investing2025 #HowToInvest10000 #SmartMoney #WealthBuilding #FinancialPlanning #RazBlogFinance

Website: http://razblog.com