Choosing between an LLC and S Corp is one of the most important financial decisions small business owners make, especially when it comes to maximizing tax savings. In 2025, the question of LLC vs S Corp has become even more relevant due to evolving tax rules, rising self-employment costs, and tighter margins.

A Limited Liability Company (LLC) and an S Corporation (S Corp) both offer liability protection, but their taxation structures are very different. If you’re looking to reduce your tax burden legally and efficiently, this guide breaks down both entities so you can decide which is best for your business goals.

An LLC is the most flexible business structure for new entrepreneurs. By default, it’s taxed as a pass-through entity. That means business income passes through to the owner’s personal tax return, avoiding double taxation. Single-member LLCs are taxed like sole proprietorships, while multi-member LLCs file partnership returns. Owners pay income tax and self-employment tax (Medicare and Social Security) on the entire business profit.

An S Corp, however, adds a layer of complexity for potential tax benefits. After forming an LLC or corporation, you must file IRS Form 2553 to elect S Corporation status. The key advantage is this: owners who work in the business can pay themselves a reasonable salary, and any profit above that salary is considered a distribution, which is not subject to self-employment taxes.

So which structure is better purely for tax savings?

Let’s break it down with a practical example. Suppose your business makes $100,000 in profit annually.

If you are an LLC taxed as a sole proprietorship, you’ll pay:

-

Income tax on $100,000

-

Self-employment tax (15.3%) on the full $100,000 = $15,300

If you elect S Corp status, and you pay yourself a $60,000 salary:

-

Income tax on the full $100,000

-

Self-employment tax only on $60,000 = $9,180

-

The $40,000 distribution avoids the 15.3% self-employment tax

This results in roughly $6,120 in tax savings—just by shifting how the income is treated.

But this isn’t free money. S Corps come with additional compliance costs:

-

You must run payroll and file W-2s

-

You must file a separate corporate tax return (Form 1120-S)

-

You need to justify what counts as a reasonable salary (based on industry norms)

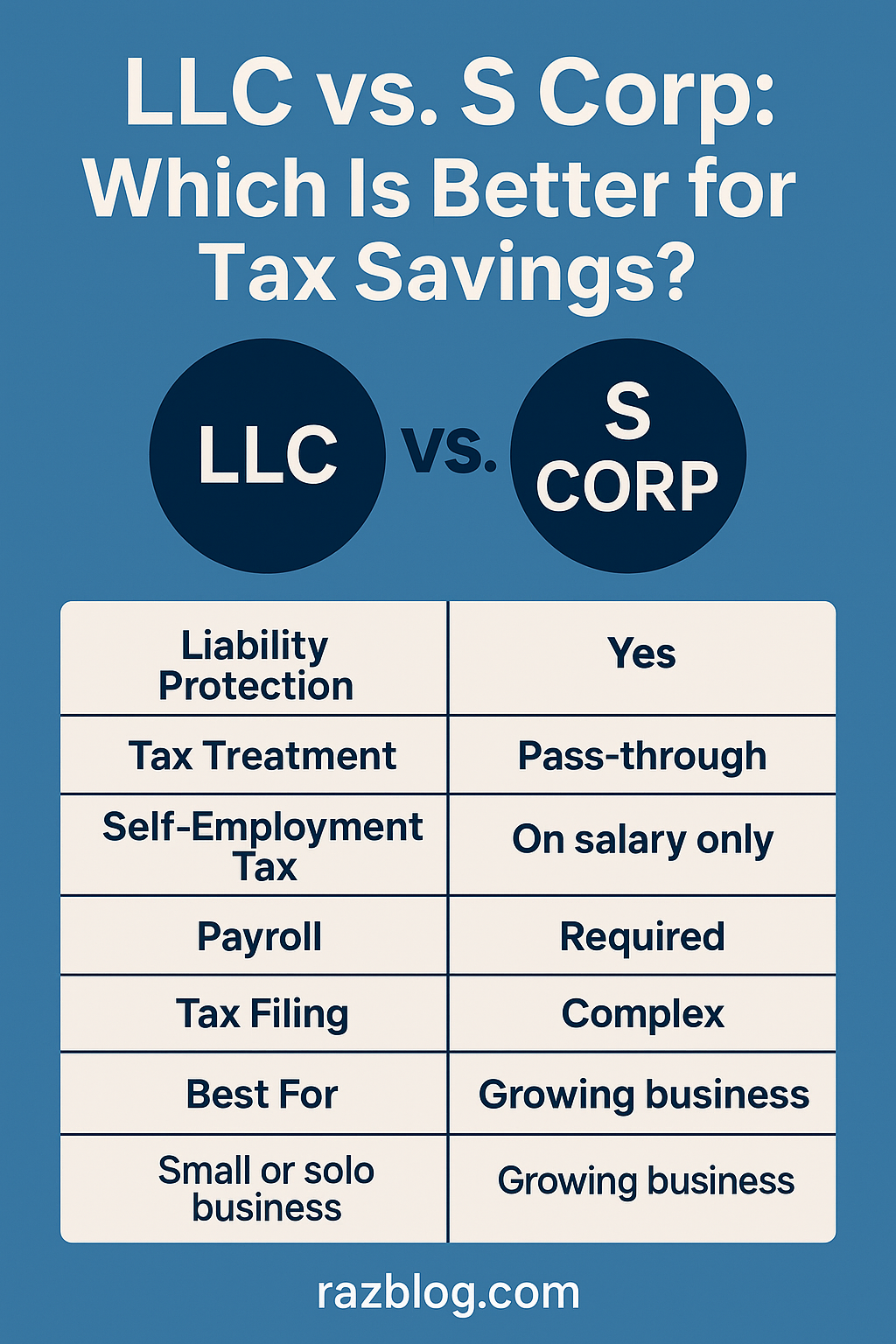

Let’s compare the key differences clearly.

LLC vs S Corp: Tax and Legal Comparison

| Feature | LLC | S Corp |

|---|---|---|

| Liability Protection | Yes | Yes |

| Default Taxation | Sole proprietorship or partnership | Corporation (pass-through) |

| Self-Employment Tax | On all profit | Only on salary |

| Payroll Requirement | No | Yes (for owner-employees) |

| Tax Filing Complexity | Simple | More complex (needs Form 1120-S) |

| Ideal For | Freelancers, side hustlers | Full-time owners with steady profit |

| Tax Savings Potential | Limited | High (after reasonable salary) |

So who should choose an LLC? If your business income is under $50,000, and you’re not running payroll, an LLC’s simplicity is a big win. You don’t need a CPA, and taxes are straightforward. It’s also the best choice if you’re a freelancer, online seller, or side hustler who doesn’t yet have consistent profits.

On the other hand, an S Corp shines once your profits exceed $80,000 to $100,000 per year and you plan to work in the business full-time. That’s where the self-employment tax savings outweigh the payroll costs and bookkeeping complexity. You’ll need to pay yourself a reasonable wage and work with a tax pro, but the long-term savings can be substantial.

Also note, you can have both. Many entrepreneurs start as an LLC, then switch to S Corp status once profits and income stabilize. This way, you start simple and go strategic when it counts.

Make sure your state rules align. Some states charge S Corps extra fees, or don’t recognize S status at all. California, for example, charges an $800 annual franchise fee to all LLCs and S Corps alike, but imposes an additional 1.5% tax on S Corp income.

When choosing between LLC and S Corp, also consider other business factors. Will you raise investment capital? Hire employees? Want to offer benefits like 401(k)s? S Corps are better suited for growth-stage businesses, while LLCs are better for flexibility and solo owners.

A quick recap for beginners:

-

Choose LLC if you want flexibility, minimal paperwork, and you’re just starting

-

Choose S Corp if you earn steady profits over $80k and want to save on self-employment tax

Ultimately, LLC vs S Corp isn’t about which one is best in general—it’s about what works best for your specific income level, state rules, and growth plans. A CPA can help you evaluate when and how to convert from one to the other if your needs evolve.

#LLCvSCorp #SmallBusinessTax #SelfEmployed #SoleProprietor #TaxSavingsTips #RazBlogFinance

Website: http://razblog.com